Content

You can see this article to have home elevators the fresh now ended brief LWA 3 hundred a week payment (particular claims make a good 400 payment) one Chairman Trump acknowledged inside the mid-August (having fun with 44bn of FEMA funding) thru executive acquisition. Very claims are making all of the payments less than this option (full number here) in addition to retroactive money. Lingering and you may normal a week costs concluded immediately after Sep sixth (few days finish September 11th in the most common claims). It means a cessation from federal pandemic unemployment professionals to have 8 million+ jobless otherwise under-functioning claimants and this that can lead to her or him losing all the current and you can future professionals within the PUA, PEUC otherwise secondary three hundred FPUC applications. Overall, technological changes while the 1970s arrive able to increasing withdrawals to own reduced uninsured depositors because of the a matter of occasions otherwise a good day or two.

The new approved lawyers, Kimberly Branscome and you will Jay Bhimani from Dechert LLP, presumably violated the fresh courtroom’s instructions to the to provide a piece of proof during the closing objections. The new Eleventh Circuit Judge governed one Legal Rodgers don’t offer the required see just before towering sanctions and you may did not reveal that the newest attorneys had acted inside crappy believe. The brand new legal can invariably sanction these lawyers, she only has to have fun with another fundamental in the giving her discipline.

How long would you hop out profit a Cd?

More details on the First Republic’s work at, when it will get readily available as a result of account because of the government bodies, may possibly provide beneficial a lot more perspective. What does they imply for you that the JPML consolidated all the fresh government earplug states inside the Florida? It indicates you to regardless of where you’re, your lawsuit will likely getting housed within the Fl while you are such litigation experience the brand new multidistrict litigation techniques. Submitting case up against 3M to have hearing loss regarding defective earplugs try unlikely so you can feeling the qualifications to possess impairment pros.

What lengths Back Can i Claim the brand new Retroactive Unemployment Pros?

This can be an appeal-influence account available at both banking institutions and you may borrowing unions that is like a savings account but also also provides particular family savings has. So it membership tends to earn a produce already of around seven moments greater than the fresh national average. At the on the web-simply banking institutions, these accounts often obtained’t have monthly solution charges otherwise minimal harmony conditions. Salem Five Lead, established in 1995 as the an internet division out of Salem Four Bank (which was centered in the 1855), now offers Special Cds ranging from nine days so you can 5 years.

Given the will cost you inside, the sole reason to use mutual deposits should be to effortlessly increase insured dumps. Desk step 1 account the new shipping out of uninsured deposits because of the financial size class. The brand new column titled “p50” suggests the new carrying away from uninsured deposits of your own average lender in the for each proportions class. Any fixed-income defense offered otherwise used just before maturity could possibly get become subject to a substantial gain or losings.

- The interest cost for all words are typical rather competitive, particularly for the fresh shorter words.

- The new recent failures of three higher U.S. banking companies have likewise demonstrated the risks out of concentrated investment offer and you can poor management of interest risks (see box step 3).

- But not, unclear economic conditions and you can rising rates of interest is actually increasing firms’ borrowing from the bank, liquidity, and interest dangers.

- You can view this short article to own info on the fresh now expired short term LWA 3 hundred each week percentage (certain says are making a great eight hundred percentage) one President Trump recognized inside mid-August (using 44bn from FEMA funding) thru executive buy.

- If your Cd has a step rates, the interest rate of the Video game could be large or all the way down than simply prevailing field cost.

- But not, they turned into understood later on that the man was to your country’s region continuously since the September 2017 (see part 11 more than).

- Such rates imply average DA deposits just after Late. 15 was as much as step 3.7 billion, as much as the same as the brand new one-fourth-prevent profile out of step three.8 billion, implying the newest work with got completed by the The fall of. 15.

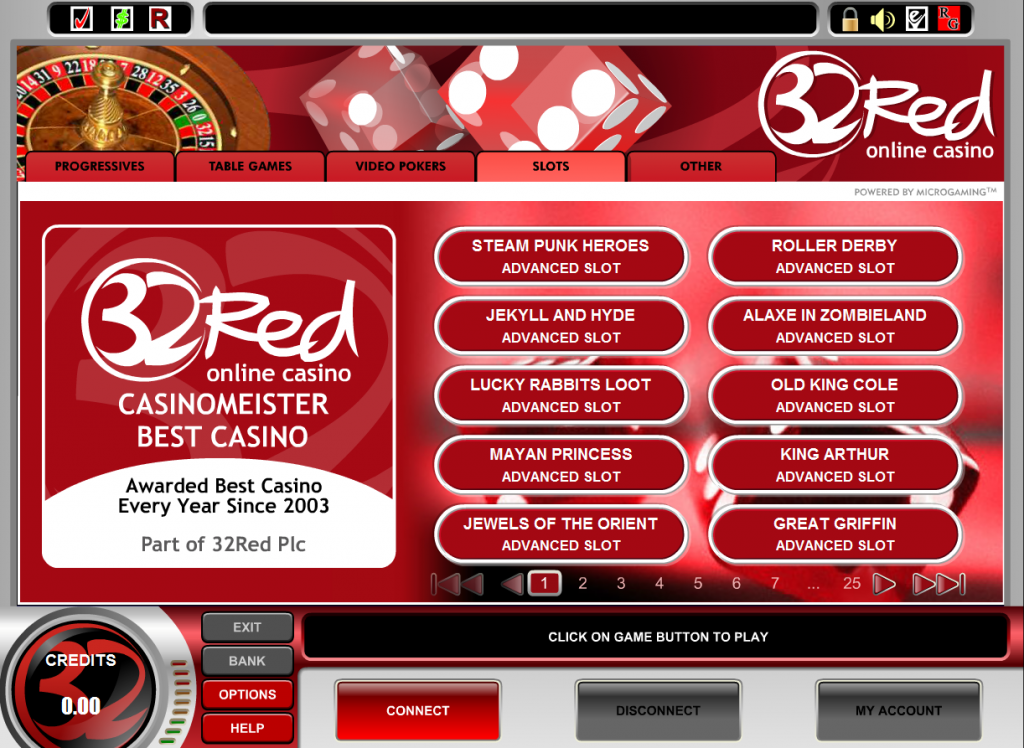

Inside the 2024, most Us banks is people in the a network, and lots of of these utilize it. IntraFi states you to 64 percent people banks take part in their circle.2 With regards to the Phone call Declaration, 44 percent of us industrial banks had an optimistic amount of mutual dumps after 2023. To your reason for https://realmoneygaming.ca/yebo-casino/ FDIC insurance rates constraints, all the depository possessions of your account manager at the establishment giving the brand new Cd will normally getting counted to the the new aggregate restriction (usually 250,000) for every applicable group of account. The the new-matter brokered Dvds Fidelity also provides are FDIC covered.

Question of VIOTTO v. The brand new REPUBLIC Of MOLDOVA – 12083/20

Over the years away from crunching quantity and terminology, I’ve already been passionate about providing subscribers build told decisions for the managing their cash having distinctively helpful advice. You will find an MBA out of George Washington University, and you may are an active member of both the Federal Drive Bar and you will SABEW, in which I’ve volunteered since the a legal due to their particular journalism prizes programs. Has just, I was chose Treasurer of the Community out of Elite group Journalists’ SDX Base (Arizona, DC section), increasing scholarship currency to possess aspiring younger journalists. Extremely Cds charge you a penalty for being able to access the cash before the definition of try up. But not, some banks offer zero-penalty Cds — also known as water Dvds — which allow you to withdraw the money very early without getting charged a punishment. Which have tariffs back into the news and many suspicion as much as just what the brand new Fed might create 2nd, it’s obviously a time to listen.

Bask Lender ‘s the on the web department out of Tx Funding Financial and you can similarly to their father or mother financial, also offers only short-term Video game terminology. Such words range from 90 days to help you two years as well as provide aggressive production. You’ll should also take a look at other banks while you are interested inside the specialization Cds, including no-penalty Dvds, while the Lie does not give any.Bask Lender have a penalty from ninety days of great interest to your its you to-12 months Video game. Cds are ideal for someone looking an ensured rates out of get back that is generally greater than a family savings. In exchange for a top rate, financing is actually tied for an appartment time frame and you can very early withdrawal penalties can get apply. As the FDIC’s circulate is intended to generate insurance coverage laws and regulations to own trust accounts much easier, it could push certain depositors more FDIC limits, considering Ken Tumin, inventor of DepositAccounts and you may elderly world specialist at the LendingTree.

Bank Business Indications Have Deteriorated

Large interest ties has usually stemmed of circumstances of higher or multinational conglomerates, unlike directly stored, personally had organizations for example Trump’s. James’ workplace delivered PolitiFact samples of businesses inside the municipal lawsuits times in the many jurisdictions publish bonds away from step 1 billion or even more on the desire. They tend to be a step 1 billion thread to own Samsung within the 2014, a good step 1 billion thread to possess Cox Communication in the 2021, and you will an excellent step 1.step 3 billion thread for SAP, a German app team, last year.

For those who have more 250,000 in the dumps at the a lender, you could be sure all your cash is insured by national. Unfortunately of a lot customers provides detailed issues with these types of retroactive repayments by which they haven’t yet acquired him or her anyway, as they had gotten their first 600 commission for each county schedules. Thus while many had been expecting a large first payment really worth thousands, it ended up delivering simply the feet 600 payment. And when they contact the local county jobless firms they cannot get a definite address and they are told only to wait while you are they obvious right back logs of brand new claimants. While the talked about in this post, the the brand new three hundred FPUC commission to have 2021 will be retroactive to your initiate day of your the brand new system publicity months in the same manner because the past additional UI work with software. Because of this right back money on the the newest three hundred FPUC commonly payable retroactively for the few days ahead of December 27th, 2020 (below CAA) or February 14th (under Biden ARP expansion), even though you were certainly getting PUA and you can PEUC for the last several months.

But it is difficult to consider depositors in 1984 otherwise 2008 since the delay by a number of days by technology of the time. Furthermore, while the reviewed within the next point, big organizations have accounted for the large almost all finance taken through the works. In the following digital financial technology, Continental might have been an early commander in a few areas. Its around the world analysis linkages had been including state-of-the-art for the attention so you can accentuate with its to another country workplace inside Brussels (Branscomb, 1983, p. 1005). Stevens (1984) means highest firms while the that have commonly provided automatic correspondence to possess lender cord transmits in their real-day bookkeeping options. As well, Ahwesh (1990) identifies business consumers because the having switch-in the automatic entry to the banking companies’ cord room and that 70percent or more from banking companies’ wire activity during the time try the consequence of these types of automated electronic access tips.